The Business Times quoted on 4 June 2024:

“Indonesia’s central bank expects the rupiah to strengthen from current levels and trade in a range of 15,300 to 15,700 per dollar in 2025. Indonesia’s Governor Perry Warjiyo saw a better outlook for the rupiah due to the prospect of a rate cut by US Federal Reserve next year and returning capital inflow into South-east Asia’s largest economy.”

Anticipating Indonesia’s Growth with a Strengthened Rupiah

Indonesia’s market presents a compelling landscape for business expansion by foreign countries over the next few years, bolstered by a strengthening rupiah. Governor Perry Warjiyo’s optimistic outlook highlights the prospect of a US Federal Reserve rate cut, which is anticipated to invigorate capital inflows into Southeast Asia’s largest economy.

Its robust economic fundamentals, strategic geographic position, and large consumer base further enhance its attractiveness. As a result, sectors such as the digital economy, manufacturing, and infrastructure development are poised for significant growth, providing lucrative opportunities for foreign investors seeking to tap into a dynamic and expanding market.

With a substantial labour force exceeding 144 million, Indonesia is an attractive destination for businesses, especially those that are labour-intensive. The large, cost-effective workforce provides a competitive edge for optimizing operational costs. This makes Indonesia appealing for foreign investors seeking to maximize efficiency and profitability in their ventures.

Predominantly, Indonesia’s labour force is engaged in the agricultural sector, the backbone of its economy. Significant segments are also employed in wholesale and retail trade, and manufacturing, highlighting diverse opportunities for business expansion.

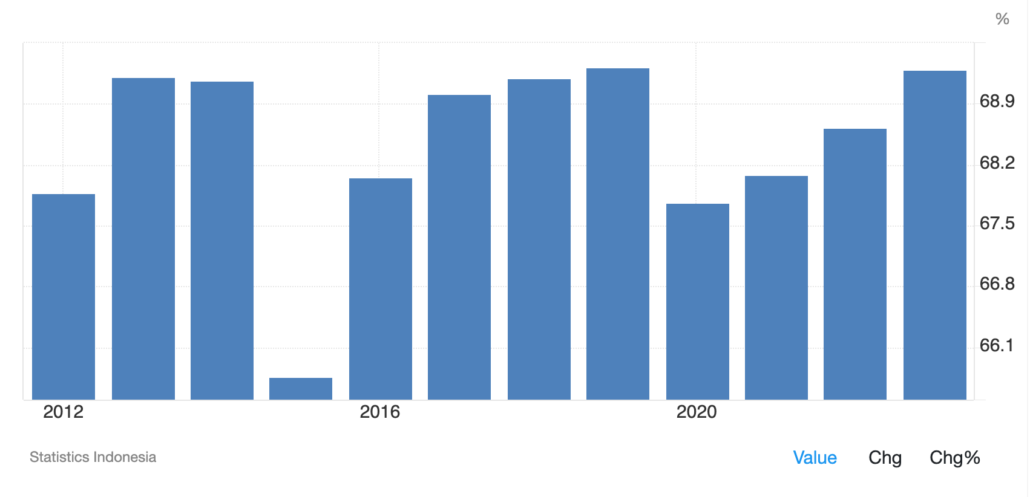

As of February 2024, approximately 142.18 million people were employed in Indonesia. After experiencing a significant decrease from 2020 to 2021, the number of employed people in Indonesia has gradually increased.

Number of employed people aged 15 years and above in Indonesia from February 2015 to February 2024 (in millions). Source: https://www.statista.com/statistics/1333739/indonesia-employment-numbers/

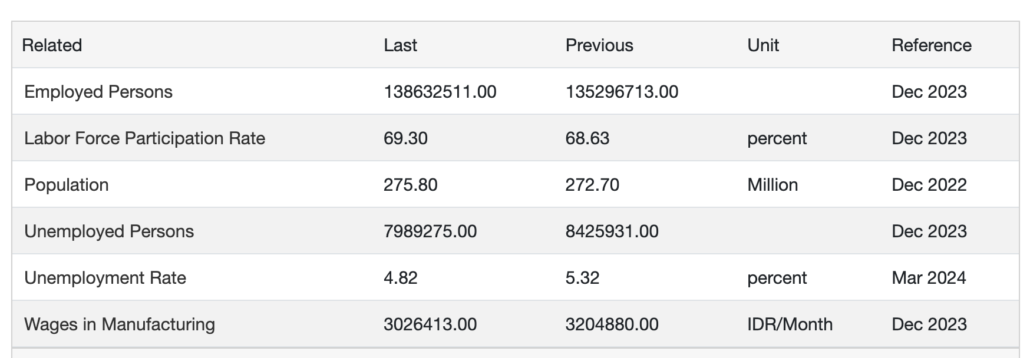

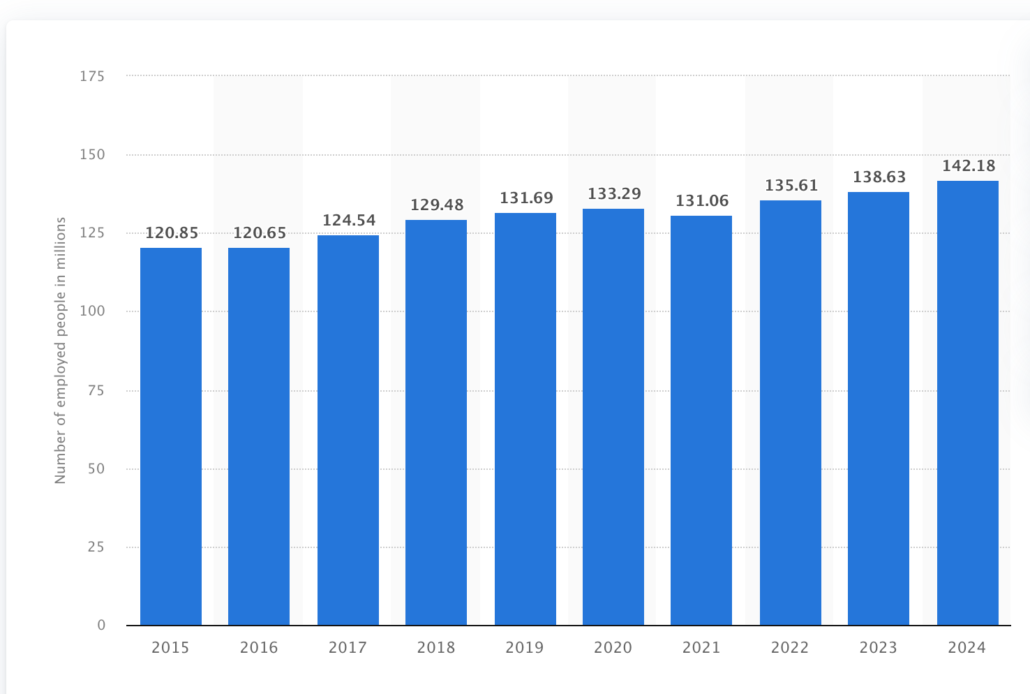

Labor Force Participation Rate in Indonesia increased to 69.30 percent in 2023 from 68.63 percent in 2022. Labor Force Participation Rate in Indonesia averaged 65.76 percent from 1990 until 2023, reaching an all time high of 69.32 percent in 2019 and a record low of 57.14 percent in 1991. Source: Statistics Indonesia.

Indonesia in 2024:

Indonesia, a vibrant archipelago rich in natural resources and cultural heritage, has become a key player in the global economy. Its strategic location and diverse industries, including agriculture, mining, manufacturing, and services, drive economic growth. Progressive government policies attract investment, positioning Indonesia for significant economic resilience and expansion.

In 2024, Indonesia shines as a beacon of economic opportunity in Southeast Asia. Strategic government policies and rich resources fuel growth and innovation. Key sectors like eCommerce, Travel and Tourism, Transportation, Renewable Energy, and Education and Healthcare drive progress, showcasing Indonesia’s economic diversity and readiness to embrace future challenges and opportunities.

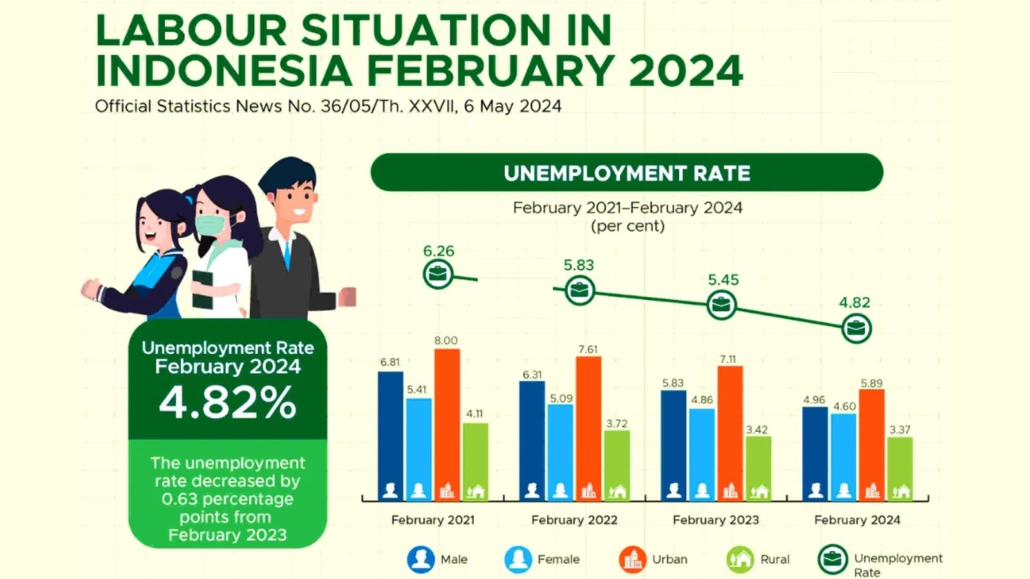

Source: https://www.humanresourcesonline.net/indonesia-s-total-labour-force-experienced-a-y-o-y-growth-of-2-76mn-people-in-february-2024

However, succeeding in Indonesia’s promising market requires careful navigation of its complex business landscape. Meeting regulatory requirements, understanding cultural intricacies, and addressing infrastructure challenges are crucial. A thoughtful and well-prepared approach, including careful planning, thorough market research, and cultural understanding, is imperative for businesses aiming to thrive in Indonesia’s dynamic and flourishing economy.

Challenges Despite Indonesia’s Positive Economic Outlook

Despite Indonesia’s promising economy and many strengths, foreign businesses expanding into this market will face several challenges.

Labour market

One of the significant challenges facing businesses in Indonesia is the structural issues within the labour market. Insufficient job creation, skills mismatches, and inadequate job-search tools hinder the effective transition from school to work. These issues create a labour market that can be difficult for businesses to navigate, especially when looking for skilled employees. Although Indonesia has a large labour force, finding skilled and specialized talent can be challenging. Labour laws can be rigid, making it difficult to manage workforce flexibility, and minimum wage regulations vary significantly across regions.

Bureaucracy and Regulatory Environment

Next, let’s look at the Indonesia’s Bureaucracy and Regulatory Environment, the expectation vs. the reality. Indonesia has a complicated regulatory system with a lot of bureaucracy, making it slow and difficult to get permits and licenses. When you think you have put in the hard work of researching your market and completing all the necessary paperwork for your business idea, registering your company in Indonesia or starting a business seems like a breeze.

Expectation: You anticipate a quick process, maybe even just a few days or hours.

Reality: It typically takes between 5 to 10 weeks, and sometimes even longer, especially if there are national holidays or collective leaves.

Navigating through the bureaucracy and regulations can be challenging, requiring a lot of patience and persistence. It’s not the final step you imagined; it’s more like a waiting game. However, knowing this beforehand can help you prepare and make the process smoother.

Corruption

Moreover, corruption remains a significant challenge in Indonesia’s business landscape. Despite ongoing efforts to combat it, businesses operating in the country may encounter demands for unofficial payments or other forms of corruption. Negotiating these ethical dilemmas while ensuring compliance with local laws and regulations adds another layer of complexity to doing business in Indonesia.

Others – Infrastructure, Legal System, Cultural, and Language barriers

While improving, Indonesia’s infrastructure, including transportation, logistics, and utilities, can still pose challenges, particularly outside major urban centres. Traffic congestion in cities like Jakarta can impact logistics and supply chain efficiency. Indonesia’s legal system can be unpredictable, with laws and regulations sometimes enforced inconsistently. Intellectual property rights protection is another area where businesses need to be cautious, as enforcement can be weak.

Then, cultural and language barriers, the expectation vs. the reality check. It is crucial to understand and adapt to local cultural practices and business etiquette. Language barriers can also be challenging as not all business professionals may speak English fluently.

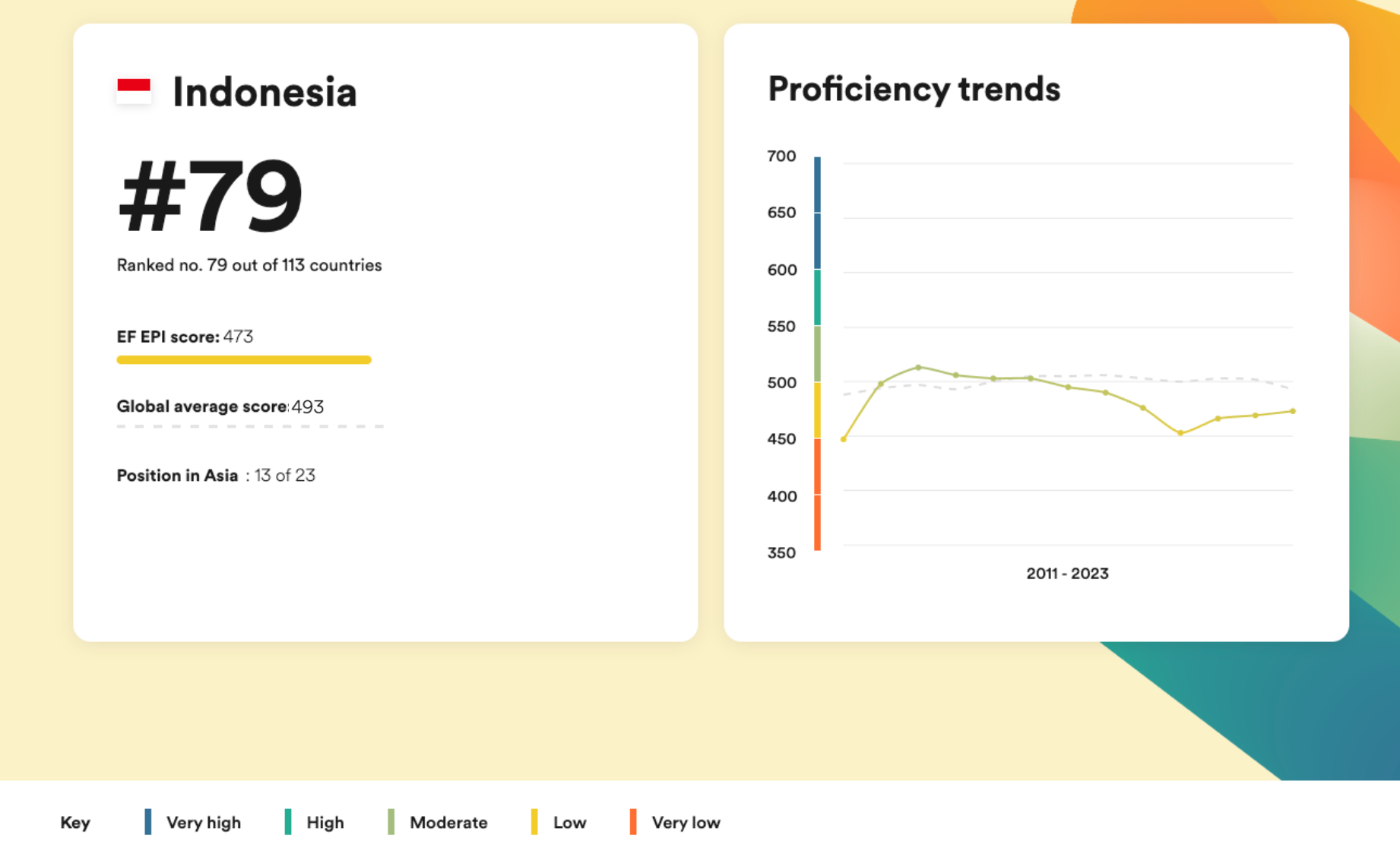

Expectation: It seems logical to expect proficiency in English from officials in such a dynamic business environment.

Reality: The quality of Indonesian English is generally low especially in rural areas.

Indonesia | EF English Proficiency Index | EF Global Site (English). Source: https://www.ef.com/wwen/epi/regions/asia/indonesia/

Despite English being taught since the first year of primary school, many Indonesians, including officials handling business registrations, struggle to communicate effectively in English. While officials in big cities like Jakarta and Bali may have some level of English proficiency, Indonesian is highly preferred. Therefore, having a local partner in Indonesia becomes essential for successful business expansion in Indonesia.

Getting the Right People – The Real Challenge

Skill and talent gaps

The skill and talent gaps present significant challenges for recruitment in Indonesia. There’s often a disconnect between the skills taught in educational institutions and those needed in the job market. This makes it difficult for recruiters to find candidates who possess the specific skills and qualifications required for available positions.

Fake degree

The widespread issue of fake degrees in Indonesia poses a significant challenge for companies, undermining the integrity of the recruitment process and potentially exposing organizations to legal and reputational risks. Individuals purchase fake academic credentials to secure employment or advance their careers, misleading employers into believing they have qualifications they lack. This practice can lead to mismatches between job requirements and candidate capabilities, ultimately hindering organizational performance.

The widespread issue of fake degrees in Indonesia poses a significant challenge for companies, undermining the integrity of the recruitment process and potentially exposing organizations to legal and reputational risks. Individuals purchase fake academic credentials to secure employment or advance their careers, misleading employers into believing they have qualifications they lack. This practice can lead to mismatches between job requirements and candidate capabilities, ultimately hindering organizational performance.

Large Population

Indonesia’s vast geography and large population make it challenging to find the ideal candidate. Qualified individuals may reside in different cities, far from the job location, and may be unwilling to relocate. This geographical barrier complicates the recruitment process, limiting the talent pool available to employers and adding another layer of difficulty to securing the right employees for specific roles.

The Next Step, Expanding Your Business to Indonesia!

Navigating Indonesia’s regulatory landscape is crucial for a smooth business expansion process. This involves dealing with company registration, taxes, and licenses, all of which require compliance with local laws.

Managing human resource options is not for everyone as well. It requires expertise, experience, and the right people. Don’t let the process slow your business down. Let us help you deal with different functions of HR for you. Be it payment, compensation, benefits programmes or even managing employee conflicts, we got you covered.

Managing human resource options is not for everyone as well. It requires expertise, experience, and the right people. Don’t let the process slow your business down. Let us help you deal with different functions of HR for you. Be it payment, compensation, benefits programmes or even managing employee conflicts, we got you covered.

Working with experienced local partners who understand Indonesian regulations can help businesses tackle the challenges and reduce risks associated with expansion.

How Link Compliance’s HR Outsourcing Services Can Help You in Indonesia?

Looking to ensure compliance and efficiency as you expand your business into the Indonesian market? Look no further than Link Compliance, your trusted local partner in HR Outsourcing and Recruitment, dedicated to optimizing your business success.

At Link Compliance, we understand the challenges of navigating Indonesia’s business landscape. With over a decade of experience, our team offers tailored solutions to streamline your business operations in Indonesia. From HR outsourcing to compliance management, we provide the expertise and support you need to thrive in this dynamic market. By leveraging our services, you can navigate the complexities of Indonesian regulations and cultural nuances more effectively, mitigate risks, and seize opportunities for sustainable growth.

Talk to our Indonesia’s representative today!

Email:

Tara Diara: td@linkcompliance.com

Ruth Sinambela: rs@linkcompliance.com

Website:

www.linkcompliance.com

Addresses:

Jakarta’s address: One Pacific Place 15th Floor, Jl. Jend. Sudirman Kav. 52-53, Kebayoran Baru, Jakarta Selatan 12190, Indonesia.

Bali’s address: The Ambengan Tenten, Jl. Imam Bonjol Gg. Rahayu No. 16A, Pemecutan Kelod, Denpasar Barat, Bali, Indonesia.

–

Singapore | Malaysia | China | Indonesia | Taiwan | USA | Vietnam | Japan | Hong Kong | Germany | Turkey