China and Southeast Asia: The World In Recession

Let’s talk about economics, to be more precise about recession. There are so many debates between economists: what causes, how to prevent or recover from recession, but everyone agrees on that it is a cycle of healthy reaction of economic growth.

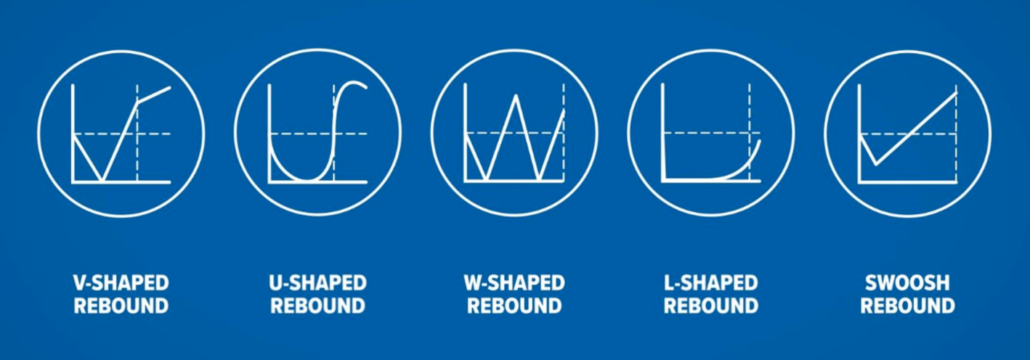

Recession: “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales”. It also has different informal “shapes” V U W L Swoosh, each to characterise recessions and their recoveries.

But what does recession mean to us, on our day-to-day life?

Well, economic recession from previous experiences we can say that it affects employment the most, and then things like spending habits, manufacturing, and sales. It is most likely that a lot of people will lose their jobs and for some time won’t be able to find a new position, that is the most devastating effect. But again, it all depends on what kind of recession it is. Since 1929 “The Great Depression” which started with recession, since then there were dozens of economic recessions. The one, we must mention is 2007 – 2009 “Great Recession”, many believe it was due US “Subprime mortgage crisis” in 2005 and many other factors. This economic downfall felt differently worldwide while in developed countries particularly in North America, South America, and Europe, fell into a severe, sustained recession, many more recently developed economies suffered far less impact, particularly China, India and Indonesia, whose economies grew substantially during this period. Similarly, Oceania suffered minimal impact, in part due to its proximity to Asian markets. After 2008s recession another point is worth mentioning is peak of global growth in 2017.

The most recent recession, which is the result of pandemic and lockdowns around the world, governments demanding on closing/work from home/study online, and travel restrictions. But there is another reason which started in 2019 with economic slowdown, it might be from tension around the globe, like oil issues between Russia and Saudi Arabia, China US trade war, and of course Brexit.

Covid – 19 pandemic recession, the effects in China and rest of Asia?

First wave of recession was end of February, global stock market noticed the worst drop since 2008. In China particularly outbreaks lead to lockdowns of cities businesses etc. which can be seen in declines in consumption and supply chain disruptions. Since the outbreak, the average two-year growth rate of China’s GDP in 2020 and 2021 is 5.1%, and the two-year average growth rates in each quarter are 5.0%, 5.5%, 4.9% and 5.2% respectively. In general, in the past two years, China’s economic slowdown has been mainly dragged down by final consumption expenditures, while external demand has played a positive role. The second largest economy in the world was the first hit by the pandemic, and many predicted it will weaken the half century striking growth of Chinese economy. But predictions were wrong, in first quarter China did see some decline, but is picked up speed in the fourth quarter, with growth, beating expectations. It was V shaped recession which started in the beginning of 2020, V shaped meaning it suffered a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery.

How other parts of Asia had reacted to the Covid-19 recession, and its consequences? (Singapore, Malaysia, Philippines, Thailand, Hong Kong)

Singapore – struggled the worst recession since its independence(1965). While the whole world had their own issues in 2020, Singapore had to deal with: high demand and supply shortages, travel restrictions and implementation of Circuit Breaker from April to June of 2020. By the end of the year some sectors of economy recovered to pre pandemic levels or came close, but areas like travel and air passengers were still significantly low compared to 2019. In 2021 Singapore’s overall GDP overpassed the full-year growth to 7.2 per cent, on the higher side of the official full-year growth forecast of “around 7 per cent”. Locals are still under some restrictions, for example, last year November Multi – Ministry Taskforce have announced that people can have a gathering of 5, previously 2.

Malaysia – due to economic restrictions and lower global demand, the pandemic wave late in 2020 helped drive the economy to its worst annual showing since the Asian financial crisis (1997). The last seen declined of Malaysia’s economic was in 2009 (-1.5%), and the economy downturn of 5.6 per cent (2020) was the lowest after 1998 (-7.4%). 2022 Bank Negara Malaysia (BNM) on Friday (Feb 4) reiterated that the Malaysian economy will expand between 5.5% and 6.5% this year, underpinned by continued expansion in global demand and higher private-sector expenditure, said governor Tan Sri Nor Shamsiah Mohd Yunus.

Philippines – in 2021 struggled its fifth consecutive quarter, The latest GDP statistics for the first quarter of 2021 showed that the Philippines economy contracted by 4.2% year-on-year, the fifth consecutive quarter of recession. This follows a severe contraction in GDP in the 2020 calendar year, with the Philippines economy having contracted by 9.6% year-on-year. In 2021 Philippines expecting GDP growth to be in range of 5% to 6%, the full year growth settled at 5.6. This year the official forecast for 2022 GDP was pegged at 7-9% with growth expected to get a boost from national elections scheduled in May.

Thailand – Covid was especially tough on Thailand. Thailand’s GDP fell by 6.1 percent in 2020, the largest contraction since the Asian financial crisis. The tourism sector, which accounts for about a fifth of GDP and 20 percent of employment, has been especially affected by the cessation of tourist travel. It hit different on each socio-economic group. In January this year, Thailand introduced new regulations affecting tourists and enterprises in the country: “including 26 provinces with “blue zone” pilot tourism destinations. And other areas, such as “orange area”, etc.”

Hong Kong – the recession started around 2019, Hong Kong’s Gross Domestic Product in 2019 contracted by 1.2% on-year, the first annual decline since 2009. In 2020 as in other countries around the world local businesses struggled the most from the new restrictions, and fear of the pandemic. But for the first half of 2021, economy grew by 7.8% over a year earlier. By the end of 2021 the economic growth was 6.4% which ended the recession. In 2022 Hong Kong expecting full recovery and growth of exported goods and local consumption level, trade reliant fields will also see benefits from China’s fast recovery from pandemic crisis. Some of the fields still will have struggles, like international travel (restrictions will continue to weigh on tourism) and related retail and services sectors.